THE FINANCIAL BOMB IS TICKING

Are The Predictions Robert Made Coming True?

Read and See His Strategy for Building Wealth NOW!

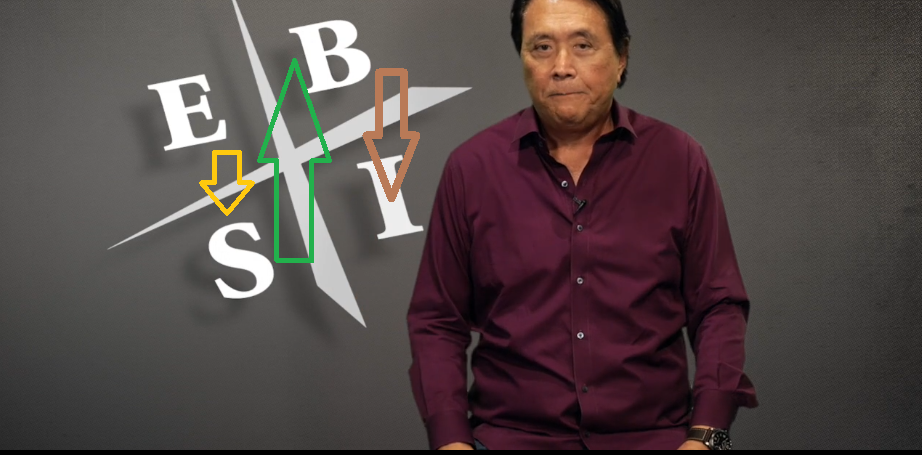

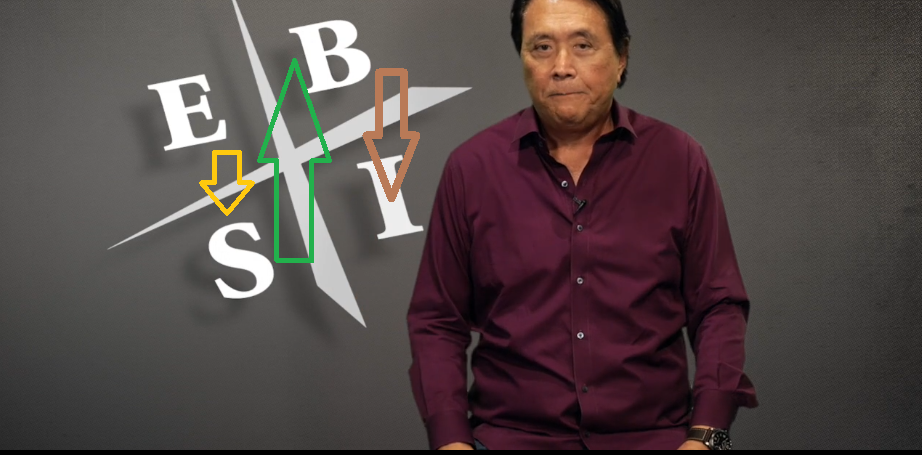

There are four types of people: Employees (E’s), Self-Employed (S’s), Big Business Owners (B’s), and Investors (I’s). The E’s and S’s are on the left side of the CASHFLOW Quadrant and the B’s and I’s are on the right side of the quadrant. Those on the left side pay the most in taxes, have the least control, and will never be truly rich. These are people like blue-collar employees but also people like doctors and lawyers who are self-employed but really don’t own a company-they own a job. They are victims to the four wealth-stealing forces. Those on the right side, however, have all the tax advantages; have control over their money, business, and investments; and have the possibility of infinite returns because they know how to create money out of thin air through passive income. And they know how to use Taxes, Debt, Inflation, and Retirement to make them even richer-not poorer. If you want to learn more about the CASHFLOW Quadrant®, I encourage you to read my book CASHFLOW Quadrant®: Rich Dad’s Guide to Financial Freedom. To be on the right side of the CASHFLOW Quadrant®, you need a high financial intelligence. That means you need to continually increase your financial education. Read books, attend seminars, network with like-minded individuals, and change your mindset.

Don’t settle for the trap of just making a lot of money. Increase your financial IQ and become truly rich.

Play Cash Flow Game online and learn the secrets to possitive cash flow now. Click here.

Job change or quadrant change?

Because of the unemployment crisis and rising cost of living, many people are going back to school or getting trained in a new profession so they can find a better job that pays more money. They are motivated by a dream of financial security and prosperity.

Move from the left to the right of the CASHFLOW Quadrant®

The Rich Dad message hasn’t and won’t change!

Change Your “E”, “B” Quadrant to “I” Quadrant.

If you’re going to invest the time and money to learn something new, learn how to operate on the B and I side of the CASHFLOW Quadrant. Same investment required, but with a better payoff!

Move from the left to the right of the CASHFLOW Quadrant®

The Rich Dad message hasn’t and won’t change.

Are You in “S” Quadrant?

Why having lots of money in “S” Quadrant doesn’t make you rich?

For example, many high-earning professionals, such as doctors and lawyers making $250,000 to $500,000, aren’t really rich at all.

Why?

Because they lose so much money to taxes, their income is based on the services they provide rather than passive income from investments, and they spend their money on liabilities like homes instead of on assets that produce cash flow.

You invest time and money now for an expectation of future income…passive income.

There are also ways that becoming an investor or entrepreneur are different from those seeking a new profession.

First, your goal is not to work for more money, your goal is to get your money working for you. Instead of looking for a better job you are looking for assets that generate passive income.

Secondly, with a profession change you are investing time and money to work for someone else. When you invest in your financial IQ you are investing in yourself and your ability to generate income without relying on an employer.

Are You Investing in The Stock Market with High Frekvency Trading ?

Stop It.

The four forces that steal your wealth

There are four things that steal your wealth: Taxes, Debt, Inflation, and Retirement. People who make a lot of money aren’t necessarily rich because they lose so much of it to those four forces. High-earning professionals are some of the highest taxed in the US, don’t have any investments that provide cash flow and hedge against inflation, are overly-burdened with debt, and aren’t ready for retirement-meaning they need their paychecks or they’re broke.

It’s entirely possible, for example, that two different people each making $100,000 could have entirely different financial lives. One could be poor and the other rich.

Here’s an example. Of the two people who both earn $100,000, one pays 20 percent in taxes, has a crippling mortgage, and saves money in a 401(k) that barely keeps up with inflation. The other pays nothing in taxes, owns rental properties that provide passive income that adjusts with inflation, and has a plan to use that passive income to purchase more passive income investments. Who’s richer?

It’s possible to make a lot of money and use the forces of taxes, debt, inflation, and retirement for your benefit-but it takes high financial intelligence.

Here’s the fundamental problem for ‘the rich’, high-income employees: They have the highest tax burden, the lowest control over their retirement, and can sell only their time.

Source: http://www.richdad.com/

We can show you how!

Join the Intra Info Global Team TODAY! Just click the „Join“ link.

Invest in Your Lifestyles Opportunity now…

Move from the left to the right of the CASHFLOW Quadrant®

My CASHFLOW Quadrant® explains this simply.

Strategy for Building Wealth by Robert Kiyosaki